Latest reviews

Every once in a while, I’m drawn to the tower defense genre, where you must dispatch with waves of enemies by building stationary defenses that fire on anything that moves in their proximity. It’s real-time-strategy reduced to the barest explodey foundations, with all action often taking place on a single screen. Unsurprisingly, the genre thrives on tablets and other mobile devices.

Cursed Treasure 2 differs from the stock formula mainly in two ways: You play as an evil overlord, and your enemies are trying to steal your stuff (gems in this case). If they steal all of it, you lose the level. That gives the player a more active role in the proceedings—you have to always keep one eye on those gemstones to prevent your enemies from absconding with them. If you have enough mana, you can summon a meteor to smush your opponents, or you can strike terror into their hearts to deter them.

After winning a level, you can play it in “night mode”, which restricts your placement options for towers to add a bit of difficulty; between levels, you can spend experience on assorted power-ups. All in all, the game offers enough variety to keep things interesting for a while—I put about a dozen hours into it.

Fighting one of the bosses in the last level. (Credit: Armor Games Studios / IriySoft. Fair use.)

The downsides:

-

There’s no story to speak of, and some of the English text on the screen would have benefited from copyediting by a native-level English speaker.

-

The game crashed once on me, and it forget its savegames a couple of times (restarting the game again made them re-appear).

-

By the time you’re really comfortable with all the mechanics, the game is over; unless you’re a dedicated completionist, night mode just doesn’t offer enough to pull you back in.

Still, you can often pick this up for a dollar, and it’s a solid game with a decent Linux port. Recommended if you’re like me and occasionally just want to fill your screen with things that go boom.

One of the main reasons for why $DOT has been receiving so much attention lately in the cryptocurrnecy space (particularly in the markets) is because of the project’s promise of future interoperability with Ethereum, Bitcoin, and a plethora of additional cryptocurrency protocols.

Below is a graphic from the project’s documentation that illustrates what this connection / bridge would look like within the Polkadot ecosystem:

While this bridge is highly theoretical and contingent on the project’s ability to succeed at something that has effectively never been done before, it appears that the overall blockchain markets are highly optimistic that this plan will come together.

Breaking Down Polkadot’s Proposed Bridges

Documentation on these proposed bridges by Polkadot can be found on their ‘wiki’ here: https://wiki.polkadot.network/docs/en/learn-bridges#bitcoin-bridge

Evaluating the Plans for a Bitcoin Bridge

Since this is presented first in the documentation’s order, we figured it would be prudent to make this our first destination for closer scrutiny / analysis.

Usually we wouldn’t take too much time to look into a project’s technical merits in this manner, but since Polkadot’s success in this endeavor has massive implications for the future of the project (especially its price action).

The specification for the Bitcoin bridge is depicted below:

What is ‘XClaim’?

The hyperlinked word ‘xclaim’ takes us to a whitepaper titled, ‘XClaim: Trustless, Interoperable Cryptocurrency-Backed Assets’

The whitepaper itself is fairly short, so let’s take a look into what its saying.

Per the Abstract:

“XClaim offers protocols for issuing, transferring, swapping and redeeming CBAs securely in a non-interactive manner on existing blockchains. We instantiate XClaimm between Bitcoin and Ethereum and evaluate our implementation; it costs less than USD 0.50 to issue an arbitrary amount of Bitcoi-backed tokens on Ethereum. We show XClaim is not only faster, but also significantly cheaper than atomic cross-chain swaps.”

From the Abstract, its relatively simple to tell that what is being proposed here is not something that’s based on a trustless protocol.

Reason Why This isn’t Trustless

Because Polkadot itself is not trustless. But it does provide a great framework for someone that would like to construct a trustless blockchain protocol.

The reason why is due to the consensus mechanism that Polkadot uses. Proof of Stake can never be considered ‘trustless’ by default because it requires a certain fault tolerance be met in order for the blockchain to continue.

If that fault tolerance is not reached, then the blockchain will halt entirely.

This was witnessed with Solana recently.

Solana Blockchain Halt Foreshadows Polkadot

In case readers are not aware, Solana’s entire blockchain came to a halt in the beginning of December due to what the developers of the protocol called a ‘bug’.

source: https://www.coindesk.com/solana-devs-call-all-hands-on-deck-as-unknown-bug-stops-block-production

Quick Side Note: Solana is also funded by the same venture capital firm that backs Polkadot, which is NGC (NEO Global Capital); notice how both projects have had excellent performances this month. Remember this and remain mindful of the fact that cryptocurrency markets are rarely, if ever, propelled by genuine technical advancements and very few development teams are motivated or capable enough to make said advancements that they propose. Thus, to their credit, they remain the world’s greatest fiction writers alive.

Before we get into Solana, its worth taking a second to step aside and prove the claim made above about NEO Global Capital’s (NGC) involvement in the protocol:

Notably, Multicoin published a report back in 2019 titled, ‘Binance is Blitzscaling’, in which they praised the exchange and also disclosed the fact that they were owners of the BNB tokens.

That statement can be seen below:

source: https://multicoin.capital/2019/11/07/binance-is-blitzscaling/

According to Multicoin, blitzscaling is defined in the following passage (just an fyi; a bit of insight into Binance’s inner workings):

“When you blitzscale, you deliberately make decisions and commit to them even though your confidence level is substantially lower than 100 percent. You accept the risk of making the wrong decision and willingly pay the cost of significant operating inefficiencies in exchange for the ability to move faster. These risks and costs are acceptable because the risk and cost of being too slow is even greater.”

One key part that many seem to have missed however, is the fact that Binance has made it openly known that they shift their user’s assets to other investments (illegally, of course, since they are not registered in any capacity to do so and certainly aren’t providing any transparent accounts of where those funds go + users are not given interest).

Specifically, Multicoin states:

“* Binance now automatically stakes their users’ assets on their behalf and distributes the yield back to them. This incentivizes users to keep assets custodied on Binance and unlocks the ability to quickly trade those assets without the need to unstake them and send to an exchange. This drives more liquidity on the Binance exchange and more assets custodied with Binance, which in turn drives greater network effects.*”

Hmm, not quite. By enticing users to “lock” their assets up with Binance in exchange for the ability to stake on their platform to yield returns in assets of questionable / no value, Binance is able to essentially able to pay people in fraudulent / fake money in exchange for the ability to use their funds to realize potential profits gained from them while they’re being “locked up”.

Since there is no way to validate that those funds are actually locked up, there’s no reason for why users should assume that they are. Instead, it is much more likely that said funds are being put to use for Binance to trade against users on the same exchange or engage in higher level ‘DeFi’ protocols within the space or slightly outside of it (i.e., with Genesis Trading or another entity of that nature).

BTC Parachain Documentation

According to the documentation:

“The BTC Parachain connects the Polkadot ecosystem with Bitcoin. It allows the creation of PolkaBTC, a fungible token that represents Bitcoin in the Polkadot ecosystem. PolkaBTC is backed by Bitcoin 1:1 and allows redeeming of the equivalent amount of Bitcoins by relying on a collateralized third-party.”

Then they provide the following graphic:

Everything in their description is fine up until the point that they claim that it, “Allows redeeming of the equivalent amount of Bitcoins by relying on a collateralized third-party”.

The main issue here is in the introduction of concepts that are not externally valid on the Bitcoin protocol (breaking the trustless property and thus, creating an unauditable pipeline / transferral of funds - something that is the antithesis of blockchain’s purpose).

Below is a diagram of how Polkadot intends on providing interoperability with Bitcoin:

As we can tell from the chart above, the Bitcoin that is being exchanged is supposed to somehow be “locked” and this ‘locking’ action will trigger the issuance of tokens called, ‘PolkaBTC’. Accordingly, Bitcoin has to be redeemed by “burning” PolkaBTC tokens.

Major Issue in This Scheme

As we move on, we can see that they validate that the transaction to the ‘XClaim protocol’ has occurred by mandating the turnover of the transaction ID as well as the block header of the block containing the relevant transaction.

The documentation even includes a graphic that shows the proposed workflow for this exchange (which results in the issuance of PolkaBTC):

Getting into the Major Issue

The major issue here is not in the design of the workflow. Its logically valid and there’s no reason to assume that it wouldn’t work.

But the issue comes in ensuring that the Bitcoin are not moved afterward.

For instance, if John decides to send 5 BTC into this ‘XClaim’ protocol, minting 5 new PolkaBTC for himself within Polkadot’s ecosystem, what is to stop John from then moving those 5 bitcoins back to his own wallet before redeeming those 5 PolkaBTC for 5 free bitcoins?

The documentation mentions a lot about “locking” bitcoins on the Bitcoin protocol, but there are are no specifics given as to how this process would take place in a manner that:

-

Ensures that the sender no longer has access to said bitcoins (or ensures that only they have access if they’re supposed to be redeeming these PolkaBTC directly for their Bitcoin)

-

Guarantees that the Bitcoin remains locked in a manner that is actually trustless and also valid on the Bitcoin protocol itself (if it is outside of the Bitcoin protocol or relies on schemes / structures foreign to the protocol, then we must consider the implementation to be completely ‘hypothetical’ in nature until the final payout is settled).

Seeking More Information

There is a chance that the documentation we read above simply does not contain the relevant details on how Bitcoin is supposed to be “locked” during this ‘swap’ (and why this would need to be collateralized if the swap is 1:1 with these minted PolkaBTC tokens).

Additionally, there was nothing included in the documentation that indicated that nodes on Polkadot would be running a Bitcoin client, so its not yet known how the protocol would be able to gauge whether the block header + transaction ID that they’re receiving is legitimate without also running a Bitcoin full node.

To find out more information we visited the official GitHub repo for the ‘BTC Parachain’, which can be found here: https://github.com/interlay/BTC-Parachain

It appears that we need to look more closely at the ‘collateral’ section in order to ascertain how this “locking” process is to take place:

Clicking the link above takes us to the part of the master tree that contains the code for the implementation of the ‘collateral’ module:

This may seem like a deadend, but it isn’t.

By examining the ‘cargo.toml’ file here (appears this is written in Rust, good choice), we find a link to the documentation included within the ‘notes’ of the code:

Bingo.

For those that wish to inspect this link for themselves, the one present in the code at the time of visit is: https://interlay.gitlab.io/polkabtc-spec/spec/collateral.html

Which should take users here:

Unfortunately, this specification contains little to no information on how the Bitcoin is to be locked.

Below are the excerpts from the documentation that mention anything about “locking” (which seems to mainly be in reference to the ‘collateral’ rather than the Bitcoin itself ; it is still unknown what the collateral is supposed to be, how it will be valued [oracles, likely], or why it is necessary):

Another problem can be found directly in the ‘overview’ section where it states:

“The Collateral module is the central storage for collateral provided by users and vaults of the system. It allows to (i) lock, (ii) release, and (iii) slash collateral of either users or vaults. It can only be accessed by other modules and not directly through external transactions.”

The fact that this collateral module can only be accessed by other modules and not via ‘external transactions’ means that we’ve abstracted beyond the Bitcoin blockchain - which makes it even more important for us to question how the bitcoins are being locked up or how we can prove a transaction unless the network is running Bitcoin full nodes.

Further Problems Caused

Unsurprisingly, the faulty foundation upon which the ‘interoperability’ protocol for Polkadot is based on leads to even greater calamities further along down the line.

We can see this clearly in the specification for the ‘PunishmentFee’.

Specifically, the documentation states:

“If a Vault misbehaves in either the redeem or replace protocol by failing to prove that it sent the correct amount of BTC to the correct address within the time limit, a vault is punished.”

Again, there are a couple of logistical issues here - and the first one is going to sound stupid, but its legitimate.

Major Issue With Time-Based Punishments: How is ‘time’ determined?

This may seem like a no-brainer, but we need to remember that we’re talking about blockchain, which means that these networks are p2p (peer-to-peer).

Thus, if this network is decentalized (and Polkadot furiously states that they are), then messages must be propagated to the network.

In other words, there is no way for one node to inform the entire network of an event all at once.

The node must spread the information to a certain subset of nodes that it is connected to, then those nodes must spread that information to other nodes and so forth until that information is propagated across the protocol.

Breaking Down Polkadot’s Network

As stated numerous times throughout Polkadot’s marketing and documentation, they rely on ‘Substrate’ to serve as the backbone of their actual network.

Therefore, any and all information about the network structure of Polkadot must be ascertained from Substrate’s documentation (as ‘substrate’ is mutually exclusive from Polkadot as a project).

This fact is enumerated directly on Parity’s website (creators of Substrate). Specifically, they state:

With that being said, if we chase down Substrate’s documentation on how they’re implemented, we find our answer on the library / structure they use to orient the actual network of Polkadot.

It is stated (verbatim) that:

“To ensure that nodes can join or leave the network at any time without affecting overall network connectivity, Substrate uses the Rust implementation of libp2p, a promising network stack that has everything needed to set up a decentralized network environment.”

Great! We just need to take a look at libp2p’s documentation and we should be up to speed on how nodes communicate on Polkadot’s network.

The design of networks using libp2p is outlined in explicit detail in their documentation.

See below:

Taking a Step Back to Look at the Bigger Picture

We’re getting a bit deep into the technicals here, so now is a good time to step back and remind ourselves what we’re doing down this rabbit hole:

A) Polkadot’s documentation details something called a ‘punishment fee’, which is doled out to “vaults” that do fail to prove it sent out the correct number of bitcoins to the correct address within a certain time limit

B) We challenged the implementation of such a standard by proposing it would be impossible to set a time limit on a vault since different peers on the network will find out about the vault requirement at different points in time (in fact, the entire network may have a different perception of the time limit). This cannot be reconciled by having one node get the time from the other because there’s no discernible way to tell if that node is lying or not. Additionally, there’s no way for that node to tell whether it is one of the first to have received the appropriate trigger to initiate the countdown

C) In order to prove our hypothesis true, we need to first establish how nodes are oriented on Polkadot’s network.

D) Since Polkadot uses Substrate (which we provided proof for), we began digging into Substrate’s documentation for more specifics on how nodes are oriented.

E) Substrate’s documentation indicated that they use the ‘libp2p’ library for node communication

F) Now we are on libp2p’s site and evaluating the documentation there to verify our assertion that Polkadot’s network communicates via ‘gossip protocol’, which means that one node tells a few nodes information it has received (relay), then those nodes tell a few nodes (each), and so forth until the information is propagated across the network

The picture above provides an accurate visual for how the gossip protocol works in this case.

Notice how each node is only communicating with 3 unique nodes, yet the total # of nodes receiving the information grows exponentially [O(n)<sup>2</sup>].

This is how propagation works on the Polkadot network. And while this is an efficient means of disseminating information on a p2p network, it introduces inevitable latency between messages (i.e., some amount of time must elapse between the receiving of a message and passing it on to a peer; this is a limitation of space, time and physics if we wish to preserve the property of ‘decentralization’)

As shown above (hopefully) the latency has a cumulative impact contingent on how many ‘hops’ must be made from the source to its destination.

Revisiting the Concept of ‘Locking’ Bitcoins on the Polkadot Platform

This may seem redundant, but it feels really worthwhile to take the time to go back and look at the notion of ‘cryptocurrency-backed assets’ (collateral) that Polkadot claims will be used to back its platform.

Within the ‘README’ of the interlay GitHub repo that we visited earlier, there’s a hyperlink to additional documentation on the protocol:

That link takes us here

Even though we’ve already reviewed this protocol (albeit, in a very topical manner) via the whitepaper we looked at earlier, it seems worth it to quickly go through this documentation here to see if there’s any greater clarification on the supposed ‘locking’ process that this protocol introduces to the interoperability equation that is liberal enough to be considered valid on the Bitcoin protocol but strict enough to restrict the sending user from arbitrarily accessing their bitcoins.

There is a diagram provided below, but it still doesn’t give us any greater information about what’s going on:

The design principles of this protocol are also flawed in a number of ways. But before we enumerate on those, let’s take a look at what they are below:

Great, so we have the promise of ‘secure audit logs’, ‘transaction inclusion proofs’, ‘proof-or-punishment’, and ‘over-collateralization’ (that last one is still a bit of a mystery since collateral should be wholly unnecessary if the process is trustless ; collateral is essentially an insurance policy on something that requires trust).

Flaw in ‘Secure Audit Logs’

According to the documentation, secure audit logs are logs that are, “Constructed to record actions of all users both on Bitcoin and Ethereum”.

This is a curious facet of the proposed protocol because there already exists such a construction. Its called ‘blockchain’ - literally, the distributed ledger itself where a record of all transactions are kept. Keeping another record is needlessly redundant, so this facet of the protocol design makes little to no sense.

Transaction Inclusion Proofs

According to the documentation:

“Chain relays are used to prove correct behavior on Bitcoin to the smart contract on Ethereum”

The first question that comes to mind is, ‘What exists to ensure that the chain relays are actually proving correct behavior?’ ; there seems to be nothing in the design that accounts for potential misbehavior by these relays. Therefore, we must trust that they’re going to do the right thing.

Objectively, there’s nothing wrong with this - but given the design goals of Polkadot, this undermines the project’s purpose.

Proof-or-Punishment

We already explored above why the ‘proof of punishment’, as specified will ultimately be ineffective (hint: Because there’s no way for the network to come to a consensus on how much time a vault has remaining because there is no way for the network to come to a consensus on when the trigger action began due to the gossip protocol).

Over-Collateralization

For this, the documentation states:

“Non-trusted intermediaries are bound by collateral, with mechanisms in place to mitigate exchange rate fluctuations”

There are a few confusing things here to be honest:

The first question that must be asked here is:

How is there even a question of ‘trusted’ vs. ‘non-trusted’?

According to the documentation on Polkadot’s website under “bridges” (right above the ‘Bitcoin bridge’ section):

“Bridge designs come in a variety of flavors ranging from centralized and trusted to more decentralized and trustless. Polkadot favors the latter bridge designs for its ecosystem…”

source: https://wiki.polkadot.network/docs/en/learn-bridges#bitcoin-bridge

Below is a screenshot of the documentation as well so that it can be read in its full context:

The documentation actually goes further than this, stating (on the same page) that:

“Bridges are specifically for making the Polkadot ecosystem compatible with external blockchains such as Bitcoin, Ethereum, or Tezos (among others). For information on XCMP, the native interoperability technology that allows parachains to trustlessly communicate, please see the dedicated crosschain page on the Wiki.”

While the XCMP is a bit different than what was described with the ‘XClaim’ protocol that is touted in other sections of the documentation, the same flaws still exist in the XCMP that existed in the XClaim protocol that we dissected earlier.

Wrap-Up

At this point, it feels like we’re beating a dead horse into the ground and its likely that most readers probably get the point by now.

Polkadot is a brilliantly designed project in many ways, with a ton of potential - but that potential is cut down short by its incessant need to take shortcuts on portions of the protocol that do not mandate such shortcuts be taken.

There are ways for Polkadot to integrate 1:1 transfers to their protocol in a manner that does not require them to use a ‘middleware’ protocol without a valid consensus, but that would require Polkadot itself to have a valid consensus algorithm (which must be Proof of Work, ultimately).

This idea and concept is one that the space will try vigorously to fight, but at the end of the day - its for the better of the protocol overall.

Auf komische und tragische Weise zugleich erzählt der Film die Geschichte von zwei Leuten mit unterschiedlichem sozialen Hintergrund. Auf der einen Seite der querschnittgelähmte, reiche Philippe, der in einem Stadtpalais mitten in Paris wohnt. Viele Mitarbeiter kümmern sich um Haus und Mensch. Auf der anderen Seite Driis aus der Pariser Vorstadt, dessen Mutter nicht seine richtige Mutter ist, mit vielen Geschwistern. Die Mutter geht putzen um die Famlie zu ernähren, die Kinder befinden sich am Rande der Kriminalität. Die Verbindung der beiden wird über den Pflegeberuf gesponnen, der ebenfalls sein Fett abbekommt. Driis erhält Arbeitslosengeld, muss sich dafür jedoch vorstellen gehen - und tut das bei Philippe. Wider Erwarten stellt er ihn zur Probe und später fest ein. Ein ständiges Spiel von Situationen, wo die beteiligten Personen nicht oder nicht genug über ihren eigenen Tellerrand hinaussehen, gibt dem Film einen roten Faden, wo man nie weiss ob man lachen oder weinen soll.

Basiert ist der Film auf dem Buch Le Second Souffle, einer wahren Geschicte von und über Philippe Pozzo di Borgo. Der Adelige, Geschäftsführer eines Champagnerhauses, ist seit 1993 querschnittgelähmt. 2003 wurde die Dokumentation à la vie, à la mort gedreht. 2017 wurde ein amerikanisches Remake von “ziemlich beste Freunde” gedreht, the upside, das jedoch nicht an das Original herankam. Philippe Pozzo di Borgo verkaufte 2010 sein Stadtpalais hôtel Pozzo di Borgo für 100 Mio Euro an die Regierung von Gabon, Ali Bongo, und lebt heute in Essaouira, Marokko. Der Algerier Abdel Yasmin Sellou, der Pozzo die Borgo 10 Jahre betreute, betreibt heute einen Hühnermastbetrieb in Algerien.

Life is Strange (reviews) established the team at Dontnod Entertainment as talented storytellers and worldbuilders. The game was a joy to explore and offered meaningful player choices that elevated it above the status of mere “walking simulator”. The story it told had a definitive ending; what, then, could a sequel have to offer?

While Life is Strange 2 occupies the same universe and is structured in a similar episodic format, it tells a completely new story, setting the series up as an anthology—think Fargo or True Detective, not Stranger Things.

The second season is about a 16-year-old kid named Sean Diaz and his little brother Daniel. After a traumatic incident, Sean and Daniel find themselves running away from home and wanted by the police.

As the player, you control Sean’s actions and define the kind of relationship you will have with your brother, and with the world you both inhabit. Will you and Daniel steal food to survive, or beg for scraps? Will you attack those who wrong you, or forgive them? Will you trust in the kindness of family and strangers, or face the odds on your own?

The story takes place in America under Donald Trump, but the writers make a point to include moments of love and tenderness alongside the darkness of racism and prejudice that Trump represents.

A story told by Sean to his little brother sums up the events so far at the beginning of each episode. In the story, Sean and Daniel are “wolf brothers”. (Credit: Dontnod Entertainment. Fair use.)

Warning: The text below contains spoilers.

Like the first season, Life is Strange 2 has a supernatural element. Early in the game, it becomes clear that Daniel possesses significant telekinetic powers. As the player, you coach Daniel on when and whether to use his powers, but you do not control them directly, and your choices are not reversible.

Life is Strange 2 improves on the first game’s graphics, which is especially noticeable during the sequences where you explore natural environments like the forests of Washington and Oregon, or a canyon in Arizona. Like the first season, the game is fully voice-acted. Unfortunately, I felt that Gonzalo Martin (Sean Diaz) often overacted his part, which is significant because he’s the main voice you’ll be hearing throughout the game.

Besides making choices and occasionally solving small inventory-based puzzles, you also get to collect souvenirs on the road, which you can inspect in your backpack later. Moreover, Sean Diaz is an aspiring artist, and at various moments you can sit down and draw in your sketchbook. You don’t directly control the pen, but you can choose between different ways Sean sees the world: Is a room you’re trapped in a prison, or can you already see a stairway to freedom?

In the last episode, you and Daniel briefly explore a canyon in Arizona, showcasing the game’s significantly improved graphics. (Credit: Dontnod Entertainment. Fair use.)

The first Life is Strange ultimately presented the player with a choice between two very different endings. Life is Strange 2 builds towards a similar choice, but the endings depend not just on that one decision, but on the cumulative effect of your actions so far. For my playthrough, this worked really well. I felt that the ending corresponded beautifully to how I had chosen to act as Sean. That’s a rare feat for a game.

I enjoyed the game, and recommend it. Like the first title, it depends heavily on the chemistry between two characters—in this case, Sean and Daniel. I did not find those characters quite as compelling as Max and Chloe in the first game, partially due to the voice acting, and partially because playing out an at times strained relationship between two siblings is just more emotionally exhausting.

I would rate the game 4.5 stars, rounded up because the team at Dontnod clearly poured their hearts and souls into this game. If you’re looking for mindless escapism completely detached from reality, this is not the game to pick, but if you invest yourself in its story and characters, the game rewards you with a narrative arc that truly feels like you’ve made it your own.

Va a Cambiar tu Manera de Pensar

Comer sushi podría ser nada más una manera de comer algo exótico, o una rutina, pero el sushi de Yokomo Sushi va a cambiar tu manera de pensar acerca de lo que el sushi puede ser.

Ética: No, ellos no van a “nada más” darte tu bendito sushi…

Para empezar, cuando ves su logo y su imagen, podrías pensar que Yokomo Sushi es un negocio más, donde una persona o un grupo de personas quieren armar un negocio con la sencilla meta de hacer dinero. Esa es una de las consecuencias de vivir en un mundo capitalista (especialmente neoliberal). En ese triste mundo, consideraciones como el buen trato y paga a los trabajadores o incluso lo sostenible que un negocio es, depende de lo que los consumidores pidan. Esto asume que el mercado viene primero y la ética después. Como si fuéramos robots. Como si los valores no valieran. Como si el mundo no fuera a hacerse lata en las próximas décadas por nuestras emisiones de CO2 (por decirlo con cautela, porque si queremos ser más explícitos, reconoceríamos que el problema incluye nuestra organización social), lo cual viene a calentar el mundo. Y todo esto nos trae a Yokomo.

Yokomo apenas abrió hacía sus entregas en el terrible duroport (es terrible porque no es para nada viable reciclarlo y toma miles de años en descomponerse, metiéndose en tus océanos y volviéndose tóxico para tu cuerpo). Mi familia se puso en contacto con ellos para dejarles ver el enorme problema que es usarlo. Y vaya vaya, nos respondieron. Hicieron un cambio excelente. Ahora, entregan su comida en empaques de cartón, bolsas biodegradables, y papel de cocina. Me encanta pedir el sushi y ver que no solamente nos escucharon, sino que nos siguen escuchando años después. En este sentido, Yokomo Sushi es un ejemplo para el mercado guatemalteco.

Por otra parte, dado que “Guate es chiquita” y la Marro es un colegio donde todos nos conocemos, sabemos un poco sobre cómo tratan a sus empleados. Y lo que escuchamos fue gratificante. Los trabajadores son tratados bien. Esto me reconforta. Es parte de lo que tomo en cuenta cuando me pregunto si quiero desayunar un McMuffin en McDonald’s con su terrible historia de maltratar a sus trabajadores, una hamburguesa de Wendy’s con su asquerosamente corrupto Gustavo Alejos, o tal vez un sushi de Yokomo. Esto último puede sonar absurdo, pero cuando quiero pedir comida de verdad que lo pienso.

Esto nos trae al siguiente punto

… ¿pero a qué costo?

Esto va a variar muchísimo. Estamos hablando de uno de los países más pobres del planeta tierra. Un país con desnutrición crónica. Tanta, que 50% de los niños chapines no crecen por estar desnutridos. Entonces, si eres un guatemalteco promedio, sería completamente absurdo, un chiste enorme, pedir Yokomo.

Pero, sabiendo eso, de manera muy incómoda puedo decirles que gano suficiente dinero como para poder pedir Yokomo sin problema. Eso no significa que lo pida a la loca. Muchas veces comparo lo que cuesta lo que como con lo que otros comen. Y por esa razón pido las cosas más baratas. Eso a veces significa comer Mc. Otras veces significa pedir, de Yokomo, los rollos más baratos. Pido El Salmón. O el KaliKomo. Ambos sólidos rollos. Pero a veces reconozco que es sencillamente una verdad que yo solito, con mi dinero, no voy a cambiar las relaciones sociales de Guatemala. Y termino pidiendo el QuesoKomo, o el Kani Explosion. Y a la madre. A la madre. A la madre.

Los rollos elaborados son demasiado ricos

¿Piensas que los rollos solamente son ricos si están fríos? Piensa en lo inferiores que son muchas cosas cuando son frías. Piensa en el pan. En el pollo. En las papas fritas. Cada una de esas cosas se vuelve tantas veces mejor cuando está caliente. ¿El sushi es la excepción?

Hay que tener cuidado. No se puede calentar un rollo a la loca. Hay que hacerlo bien. Y Yokomo lo logra con su QuesoKomo y el Kani Explosion. Entonces, ¿el sushi es la excepción?

No. Para nada. No si Yokomo te hace el sushi. Y eso es parte de por qué pido Yokomo. Sus rollos más elaborados son explosiones de sabores. La Kani Salad en el Kani Explosion es demasiado rica. La salsa preparada que la acompaña es una idea genial, y realmente mejora todo lo que toca. El Queso Komo caliente es bajado del cielo. Uff. ¡Quiero comerme uno ahora!

Conclusión

Si recuerdan, yo les dije que Yokomo era excepcional porque no era una empresa que nada más buscaba el asqueroso objetivo de maximizar ganancias. Sino que además, era responsable en cuanto a el trato a trabajadores y su responsabilidad ambiental. Claro que la parte ambiental parece haber sido en respuesta a la demanda consumidora en vez de su propia iniciativa. Por lo menos ahora sé que ellos se informan, saben buscar la ciencia confiable y se preocupan por los demás. Eso me es suficiente.

Pero ellos van más allá. Sus rollos elaborados son excelentes. Sí, son caros y me siento culpable cuando los pido porque vivimos en un país viciosamente desigual y pobre. Pero a la vez, los rollos y sus salsas preparadas son excelentes.

Helen Sjöholm gör en fantastisk artistinsats i sin “skrotorkester”-version av Hellmans poplåt. Röstresurserna är som vanligt enastående och utstrålningen likaså. Arrangemanget håller en på spetsen och de ovanliga instrumentvalen håller en på tåspetsarna hela tiden. Framförallt hanteras bastuban av Kalle Jakobsson skickligt.

Small biological miracles occur all around us. Birds, dragonflies, moths, or butterflies you observe during a hiking trip may be in the middle of migrations that require them to navigate distances of hundreds or even thousands of kilometers. A honeybee feeding on the nectar of a sunflower in your backyard may later share its distance and direction with the hive by way of a complicated waggle dance.

In an age where many of us rely on computers and satellites to tell us where to go when we travel off our beaten paths, these feats of animal navigation are all the more impressive. To find their way, animals rely on the sun, the moon, and the stars; on sound, sight and smell; even on superpowers we lack, like the detection of subtle variations in the intensity, inclination, and declination of the Earth’s geomagnetic field.

In Supernavigators, David Barrie reveals the navigational tools and methods utilized by animals ranging from insects to humpback whales. He compares them with navigation strategies employed by humans, from Polynesian voyagers to the Long Range Desert Group, a British reconnaissance and raiding unit in World War II.

Barrie is no stranger to the subject of navigation. His previous book, Sextant, focused on the use of the titular instrument for celestial navigation, and the author is an experienced sailor. Like many popular science books, Supernavigators is not just about what we know, but also how we know it. Barrie visited and interviewed many scientists, and he even accompanied a scientific expedition studying the long-distance seasonal migrations of bogong moths.

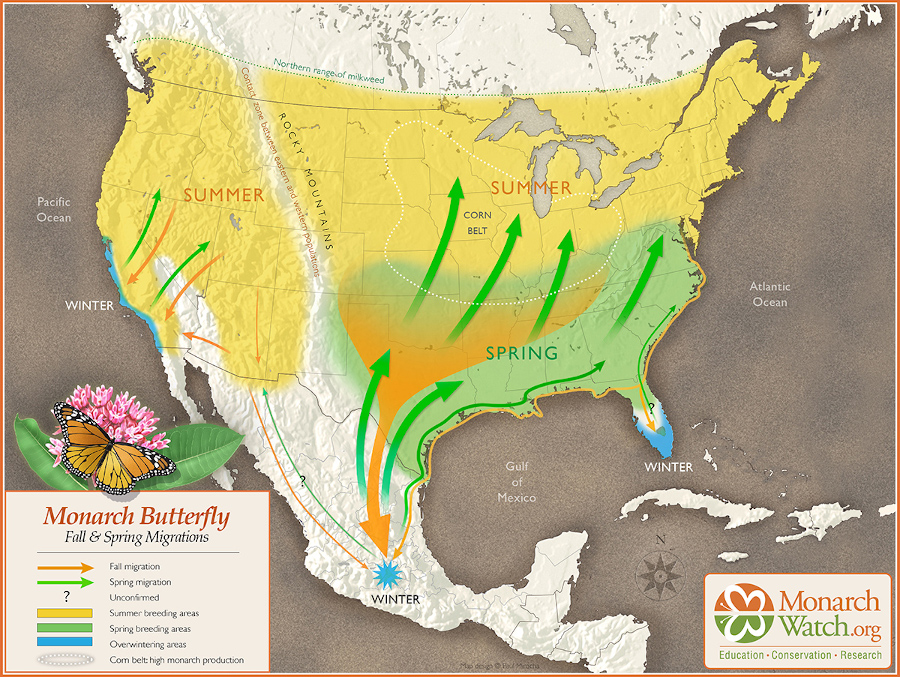

Monarch butterflies travel up to thousands of kilometers as part of their seasonal migrations. To navigate over these large distances, they are aided by a time-compensated sun compass sense. (Credit: Paul Mirocha / MonarchWatch.org. Fair use.)

Journey Into Minds

Knowing how animals find their way across vast distances may seem like a problem of elimination. Given an animal’s ability to see, smell, listen, feel, or sense, which sensory inputs actually matter for a long-distance journey? To test competing hypotheses, animals are deprived of vision or smell, displaced, confused with false sensory inputs, placed in funnels, tagged, tracked, and sometimes even mutilated.

One pattern that emerges from the many experiments described by Barrie is that animal minds—even those of insects—are complex, and animals often make the best use of all navigational information available to them. A subtle change in geomagnetic inclination may be no less important than the smell of coastal vegetation, the direction of the wind, or the movement of stars around the Northern Star.

Towards the end of the book, Barrie briefly criticizes the long history of anthropocentrism in biology, which essentially reduced animals to stimulus-response robots categorically distinct from humans. He reminds us that we are animals, and appeals to us to not let our own navigational skills atrophy. Becoming literate in the “language of the Earth” is a way for us to remain connected to our planet, and to treasure the richness of life on it.

The Verdict

Supernavigators made me say “wow” out loud a few times as I read it; this is testament both to the fascinating subject matter, and Barrie’s ability to convey it. I appreciated the simple sketches that illustrate some navigational concepts, and the brief anecdotes at the end of each chapter that are meant to show how little we still know about animal navigation. While the book would have benefited from some more synthesis and a bit less repetition, if you are interested in the subject, I don’t think you’ll be disappointed. 4.5 stars, rounded up.

You are Maxine “Max” Caulfield. You are 18 years old. You live in Arcadia Bay, a seaside town in the US state of Oregon. You’re a student at a private high school with an arts and science focus. No matter whether you’re at school, at home, or at play, you and your Polaroid camera as inseparable. Perhaps one day your pictures will catch the eye of Mark Jefferson, a famous photographer who teaches at your school?

This is the seemingly ordinary setting of Life is Strange, a narrative adventure game developed by Dontnod Entertainment and published episodically through 2015. The game is played in a third-person 3D view, rendered in an artistic style situated firmly between painterly and photorealistic. While not up to today’s technical standards, the game world is still beautiful and immersive.

Your experience as Max starts with a nightmarish vision of destruction. But it was only a daydream; you’re in school, and Mr. Jefferson is asking you about the technical process that gave rise to the first photographic self-portraits. It’s only after a dramatic encounter with a childhood friend, Chloe Price, that things really get strange. And what is the story behind the disappearance of Chloe’s friend, Rachel Amber?

Max in Chloe’s room. The game lets you explore its rich environments at your own pace, taking in every detail if you want to. (Credit: Dontnod Entertainment. Fair use.)

In terms of gameplay, Life is Strange has much in common with classic point-and-click adventure games: You spend a lot of your time exploring, talking to other characters, and solving small puzzles. There’s no unlimited inventory—occasionally a puzzle may involve finding an object and carrying it from one location to another. There is one additional game mechanic (spoilers ahead):

Warning: The text below contains spoilers.

You discover early in the game that you have a limited ability to reverse the flow of time. This often allows you to try different decision paths and compare outcomes. It makes for a world that feels real and responsive (decisions have consequences) without painting you into a corner.

The game is fully voiced, and it’s a joy to poke at objects in the environment and listen to Max reflect on what she sees in the world around her. If you sit down on a bench, you may be rewarded with some additional wide angle camera views and narration. If you prefer to rush through the story, you can do that, too.

Life is Strange is not a perfect game (some scenes overstay their welcome, for example), but I still consider it a masterpiece in interactive storytelling. It’s a joy to explore Arcadia Bay, thanks to the excellent art direction and attention to detail. The wonderful chemistry between Max and Chloe invests the player in both characters.

The first episode of the game is available for free, and you can often pick the whole game up for under $5. Thanks to Feral Interactive, there is an excellent Linux port, as well. If your computer is not a potato and you enjoy narrative adventure games, Life is Strange is one title you won’t want to miss.

Das Miniatur-Wunderland ist nicht einfach nur “Mal-eben-Eisenbahn-schauen”, sondern man merkt an allen Ecken und Enden dass das Team rund um die beiden Macher hier jede Menge Herzblut einfließen lässt. Das geht los bei den unzähligen Taster-Aktionen und endet bei den ganzen versteckten Kleinigkeiten auf der kompletten Anlage. Da geraten die Züge schon fast zur Nebensächlichkeit. Und das will bei einer Modelleisenbahnaalage schon etwas heißen.

Feuerwehr- und Polizeieinsatz an einem Fluß auf der Miniatur-Wunderland Anlage (Eigenes Werk. Lizenz: CC-BY-SA.)

Ausblick auf ein Bahnhofsdiorama in der Anlage (Eigenes Werk. Lizenz: CC-BY-SA.)

Muss ich hier noch mehr schreiben? Ich glaube nicht, denn der Ruf eilt dem Miniatur-Wunderland weit voraus und ist gerechtfertigt. Nur die kleine Kantine, anders würde ich das Restaurant nicht bezeichnen, ist ein kleiner Ausreißer aber kann die Wertung für die Anlage nicht schmälern. Pommes, Schnitzel und Co. gibt es woanders besser aber für den kleinen Hunger ist es O.K.

Nächtlicher Ausblick auf einen kleinen Bahnhof innerhalb der Anlage (Eigenes Werk. Lizenz: CC-BY-SA.)

Schön, neu und informativ sind die drei Schlagworte, die ich für diesen tollen Baumwipfelpfad vergeben würde. Mit einer sehr moderaten Steigung und einer angenehmen Länge ist er für fast alle Besucher geeignet. Unterwegs sind an jeder Plattform Informationstafeln aufgestellt , die über den Wald und seine Bewohner informieren. Und man erhält auch einen Blick von oben in den angrenzenden Wildtierpark. Sehr schön.

Am Anfang des Pfades (Eigenes Werk. Lizenz: CC-BY-SA.)

Auf dem abschließendem, 40 Meter hohen Turm erhält man einen guten Rundumblick auf die nördliche Lüneburger Heide. Dieser ist für mobilitätseingeschränkte Personen mit einem Lift erreichbar.

Der Turm mit Aussichtsplattform (Eigenes Werk. Lizenz: CC-BY-SA.)

Aussicht vom Turm auf die Nordheide (Eigenes Werk. Lizenz: CC-BY-SA.)

Abschließend kann man sich im Café noch mit einer kleinen Stärkung versorgen.

Alles in allem ein lohnenswertes Ausflugsziel.